Hashdex sits down with SEC over spot Bitcoin ETF application

@xrpfuturemillionaire Maybe you are interested#XRPHOLDERS DO WE HAVE EYES ON THE 2020 UPTREND? #XRP SETS FOR RETEST ” #BTC DXY+#USA #JOBS REPORT PART1

Asset manager Hashdex recently met with the United States Securities and Exchange Commission (SEC) to discuss its application for a Bitcoin Futures exchange-traded fund (ETF). The meeting presented Hashdex’s unique mechanism for trading and holding spot Bitcoin within the ETF, which sets it apart from other applications in the market. Hashdex aims to acquire spot Bitcoin from physical exchanges within the Chicago Mercantile Exchange (CME) market, relying on CME pricing for transactions. The SEC may request more information before the application’s deadline on November 17. If approved, the ETF will join other major asset managers in the race to list the first spot Bitcoin ETF in the United States.

Hashdex’s Meeting with SEC Regarding Hashdex Bitcoin Futures ETF

Hashdex, a leading asset manager, recently held a significant meeting with the United States Securities and Exchange Commission (SEC) to discuss its application for the Hashdex Bitcoin Futures exchange-traded fund (ETF). The meeting, which took place on October 13, brought together key stakeholders from Hashdex, NYSE Arca, Tidal Financial Group, and the law firm K&L Gates. The purpose of the meeting was to address any concerns and provide detailed information about the proposed ETF’s mechanism for trading and holding spot Bitcoin.

Meeting Details

The meeting between Hashdex and the SEC was a crucial step in the approval process for the Hashdex Bitcoin Futures ETF. It involved representatives from various organizations, highlighting the significance of the discussion. The meeting provided an opportunity for Hashdex to present its innovative approach to incorporating spot Bitcoin trading within the ETF, which has the potential to revolutionize the cryptocurrency market.

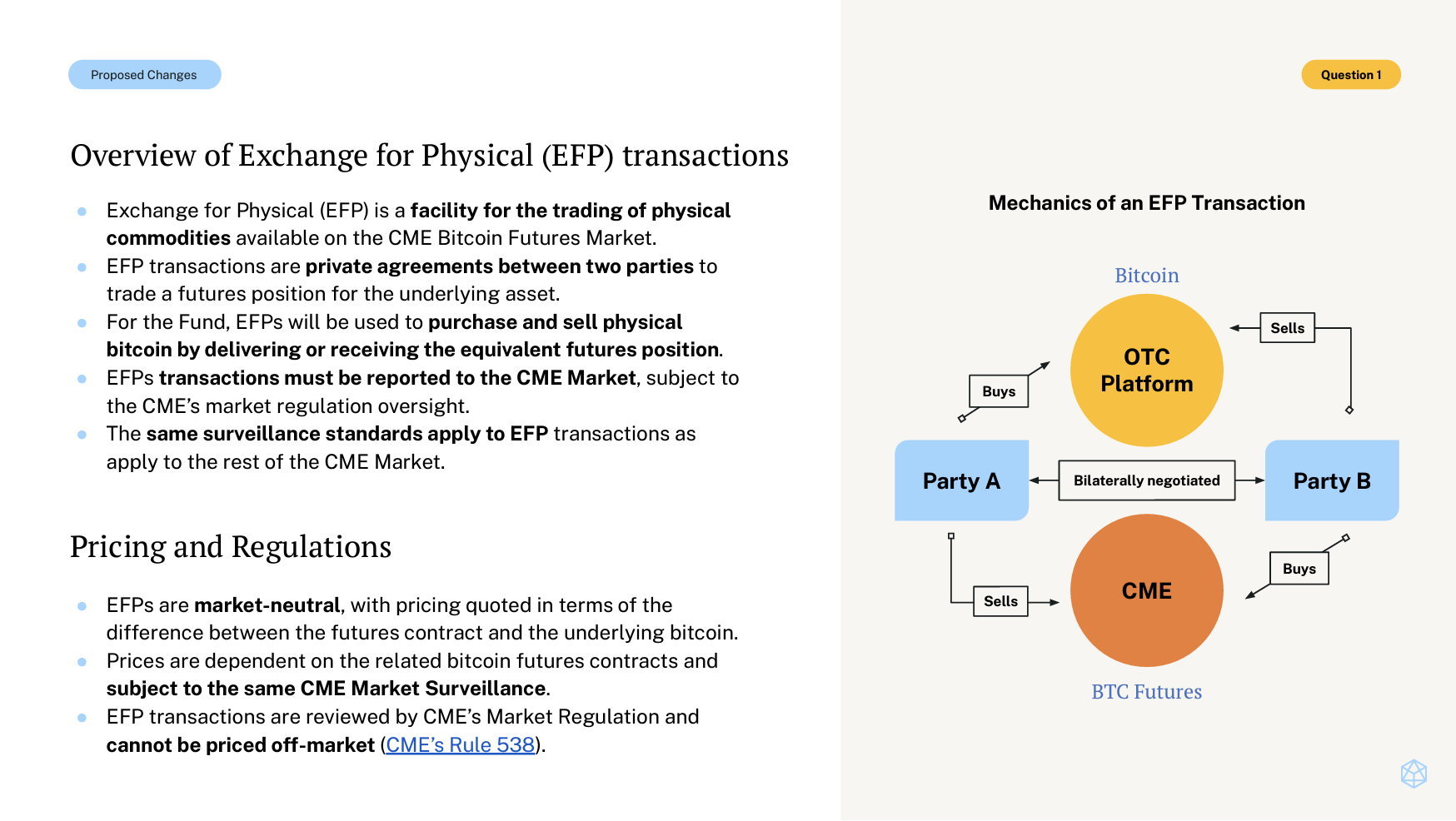

Hashdex’s Mechanism for Trading and Holding Spot Bitcoin

Hashdex’s proposed mechanism for trading and holding spot Bitcoin within the ETF sets it apart from other applications in the market. Unlike its competitors, Hashdex does not rely on a surveillance-sharing agreement with a specific crypto exchange. Instead, the company aims to acquire spot Bitcoin from reputable physical exchanges within the Chicago Mercantile Exchange (CME) market. This approach ensures transparency and compliance with the Commodity Futures Trading Commission’s regulations. By leveraging the CME pricing, Hashdex aims to provide investors with a secure and regulated platform to access the Bitcoin market.

See more : BlackRock’s iShares Bitcoin ETF mysteriously disappears — then reappears — on DTCC site

Overall, the meeting between Hashdex and the SEC demonstrated the company’s commitment to transparency, regulatory compliance, and innovation. The proposed mechanism for trading and holding spot Bitcoin within the ETF showcases Hashdex’s expertise in navigating the complex cryptocurrency landscape.

Unique Features of Hashdex’s Filing

Hashdex’s filing for the Bitcoin Futures ETF stands out due to its unique features that differentiate it from other applications in the market. These distinctive elements demonstrate Hashdex’s innovative approach and commitment to providing investors with a secure and regulated platform for accessing the Bitcoin market.

Acquiring Spot BTC from Physical Exchanges within CME Market

One of the key aspects of Hashdex’s filing is its proposal to acquire spot Bitcoin from physical exchanges within the Chicago Mercantile Exchange (CME) market. This approach ensures that the ETF’s transactions are conducted with Bitcoin obtained directly from reputable and regulated exchanges. By sourcing spot BTC from physical exchanges, Hashdex aims to enhance transparency and mitigate the risks associated with relying on a single crypto exchange for trading.

Reliance on CME Pricing for Transactions

Unlike other spot Bitcoin applications that rely on surveillance-sharing agreements with specific crypto exchanges, Hashdex’s filing takes a different approach. The ETF’s transactions will be entirely reliant on the pricing provided by the Chicago Mercantile Exchange (CME). By leveraging CME pricing, Hashdex aims to ensure fair and accurate valuation of Bitcoin within the ETF. This reliance on CME pricing adds an additional layer of credibility and regulatory compliance to the proposed ETF.

By adopting these unique features, Hashdex’s filing for the Bitcoin Futures ETF sets itself apart from its competitors. The company’s commitment to transparency, regulatory compliance, and reliance on reputable exchanges positions it as a trustworthy and innovative player in the cryptocurrency market.

Next Steps and Potential Approval

Following the meeting between Hashdex and the United States Securities and Exchange Commission (SEC), the next steps in the approval process for the Hashdex Bitcoin Futures ETF are crucial. The outcome of these steps will determine whether the ETF will be granted regulatory approval and become available to investors.

Possible Request for More Information

As part of the evaluation process, the SEC may request additional information from Hashdex before the application’s first deadline on November 17. This request indicates the thoroughness of the SEC’s review and its commitment to ensuring that all necessary information is provided to make an informed decision. Hashdex will need to promptly and comprehensively address any inquiries from the SEC to demonstrate the viability and compliance of its proposed ETF.

Application’s First Deadline on Nov. 17

See more : Skybridge Capital’s Scaramucci Corrects Bitcoin Price Forecast

The first deadline for the Hashdex Bitcoin Futures ETF application is set for November 17. This deadline marks an important milestone in the approval process, as it sets the timeline for the SEC’s decision-making. The SEC will carefully evaluate the application, considering factors such as investor protection, market integrity, and compliance with regulatory requirements. The outcome of this evaluation will determine whether the ETF will move forward in the approval process or face further scrutiny.

While the approval of the Hashdex Bitcoin Futures ETF is not guaranteed, the meeting with the SEC and the progress made thus far indicate a positive trajectory. If the ETF receives regulatory approval, it will provide investors with a regulated and accessible avenue to gain exposure to the Bitcoin market. The potential approval of the Hashdex Bitcoin Futures ETF also reflects the growing interest and acceptance of cryptocurrencies in the financial industry.

Race to List First Spot Bitcoin ETF in the United States

The competition among major asset managers to list the first spot Bitcoin exchange-traded fund (ETF) in the United States is heating up. These ETFs aim to provide investors with direct exposure to the price movements of Bitcoin, without the need to own the cryptocurrency itself. One of the frontrunners in this race is BlackRock, a global investment management firm.

BlackRock’s ETF Proposal Listed on DTCC

BlackRock’s ETF proposal recently made a significant stride forward with its listing on the Depository Trust & Clearing Corporation (DTCC). This development suggests that regulatory approval for the ETF may be on the horizon. The listing on DTCC, a trusted and widely recognized financial market infrastructure, adds credibility to BlackRock’s proposal and signals the potential for a breakthrough in the spot Bitcoin ETF market.

Expectation of SEC Approving Spot ETFs within Three Months

Industry experts and analysts anticipate that the United States Securities and Exchange Commission (SEC) will approve all spot Bitcoin ETFs within the next three months. This optimistic outlook is based on the growing acceptance and recognition of cryptocurrencies in the financial industry. The SEC’s approval of these ETFs would open up new investment opportunities for individuals and institutions, providing them with a regulated and accessible way to participate in the Bitcoin market.

The race to list the first spot Bitcoin ETF in the United States reflects the increasing demand for innovative investment products that cater to the evolving needs of investors. As asset managers compete to bring these ETFs to market, investors eagerly await the opportunity to gain exposure to Bitcoin through regulated and transparent investment vehicles.

Asset manager Hashdex recently met with the SEC to discuss its application for a Bitcoin Futures ETF that would hold spot Bitcoin. Unlike other applications, Hashdex proposes acquiring spot BTC from physical exchanges within the CME market. The SEC may request more information before the application’s deadline on November 17. If approved, the ETF will join other asset managers in the race to list the first spot Bitcoin ETF in the US. Stay tuned for updates on this exciting development in the cryptocurrency market.

Source: https://cupstograms.net

Category: Crypto