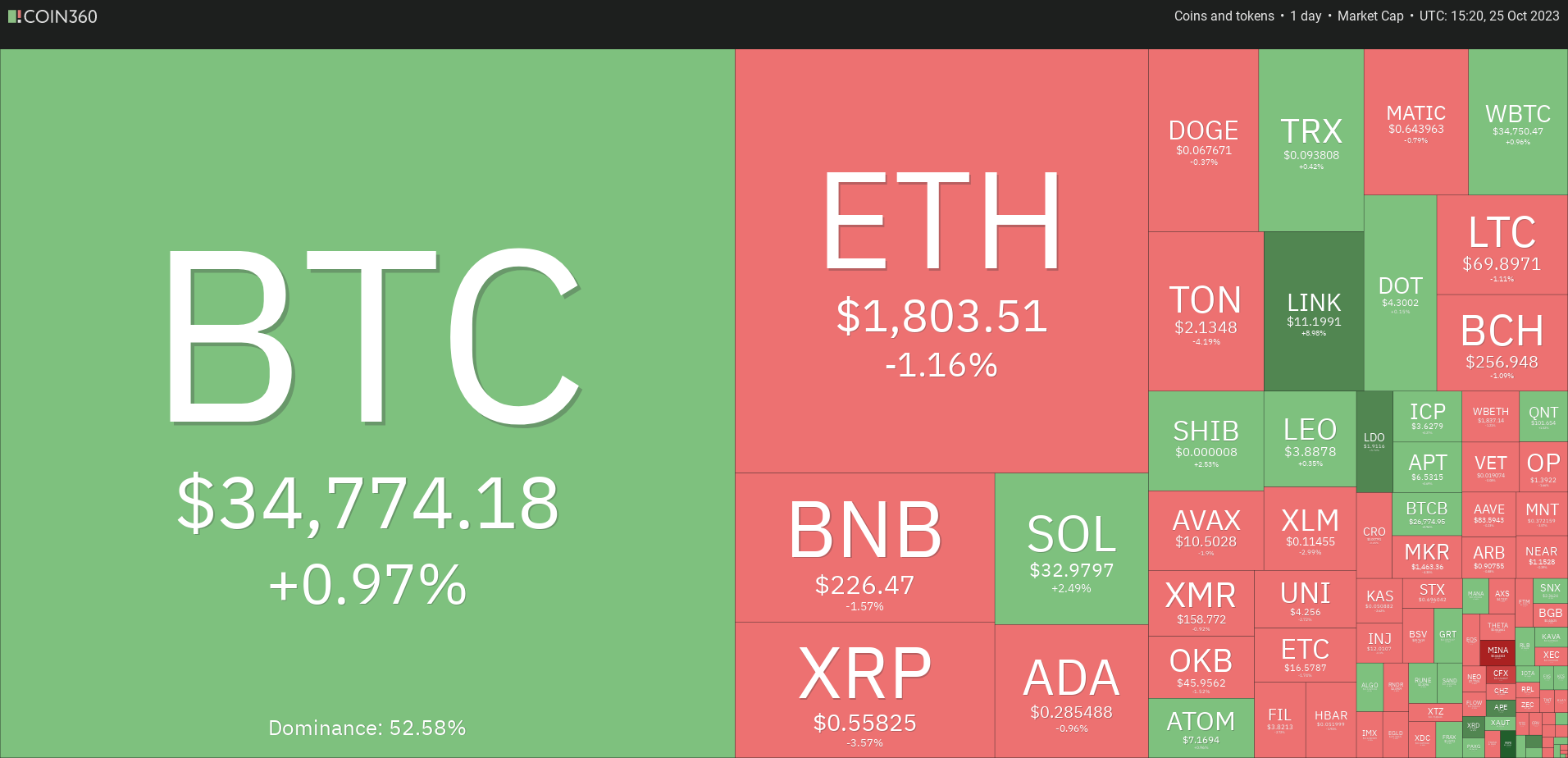

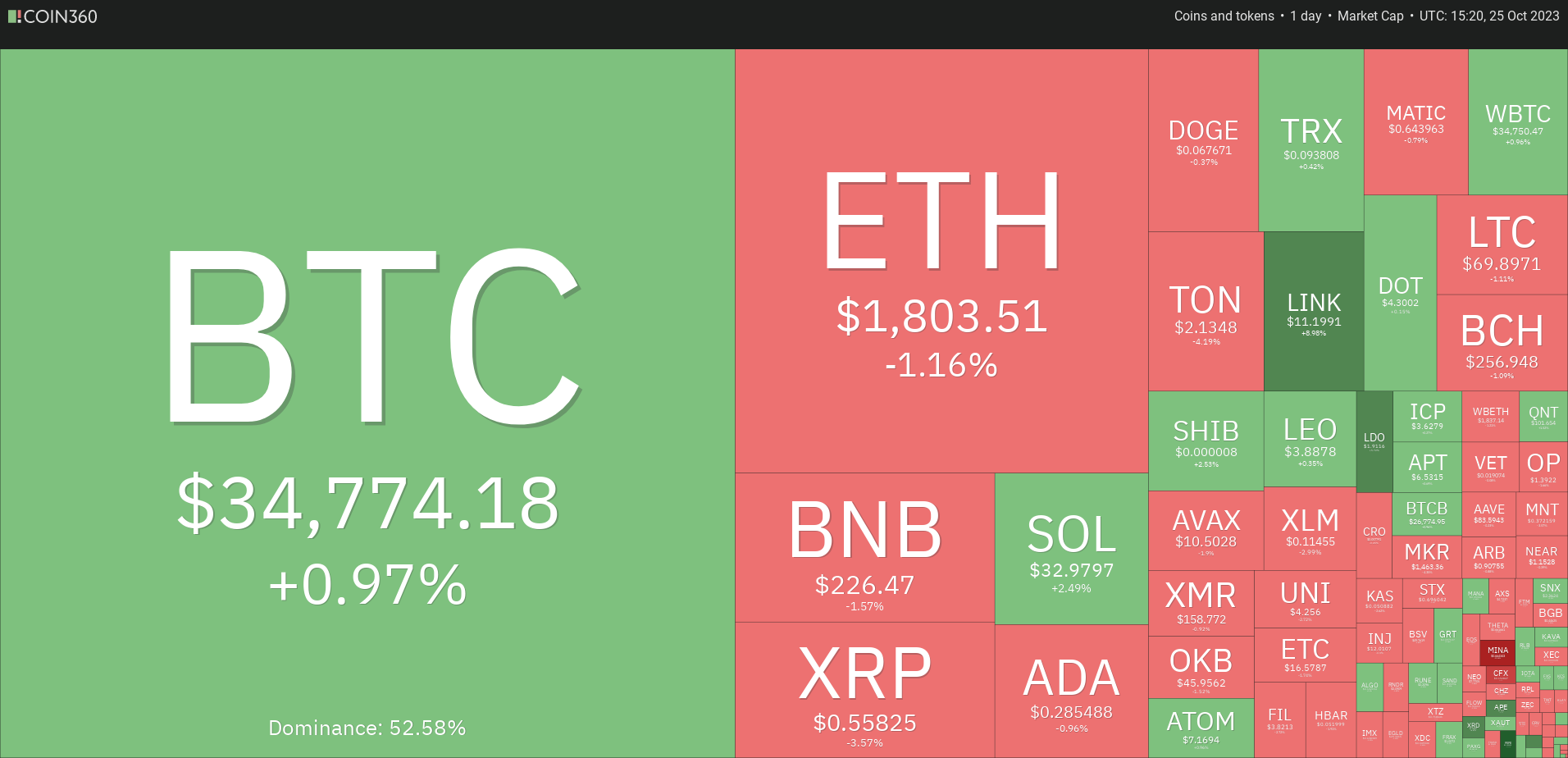

BTC, ETH, BNB, XRP, SOL, ADA, DOGE, TON, LINK, MATIC

@worldwarbitcoin Maybe you are interested

- Bitcoin’s (BTC) Jump to $37,000: Here’s What Happened Recently

- Blockchain embraces gold to provide stability and growth for crypto assets

- Bitcoin ETF Approval Anticipation Propels Significant Weekly Surge

- Bitcoin (BTC) Hints at Possible Price Correction If This Pattern Validates

- DYdX Chain Finally Kicks off in Open Source, Welcomes dApps

Here are my profit taking levels for the top ten #cryptocurrencies #greenscreen #fyp #cryptok #Bitcoin #BTC #Ethereum #ETH #Binance #BNB #Ripple #XRP #Solana #SOL #Dogecoin #DOGE #Cardano #ADA #TRON #TRX #Toncoin #TON #Polygon #MATIC

Bitcoin (BTC) has surged above the $31,000 to $32,400 resistance zone, surprising many market participants. The anticipation of a Bitcoin spot exchange-traded fund (ETF) receiving approval has fueled bullish sentiment. Analysts expect Bitcoin’s price to rally by 74.1% in the first year after a US ETF launch. Other top cryptocurrencies like Ether (ETH), Binance Coin (BNB), XRP, Solana (SOL), Cardano (ADA), Dogecoin (DOGE), Toncoin (TON), Chainlink (LINK), and Polygon (MATIC) are also showing signs of potential upward movement. However, it’s important to conduct thorough research and exercise caution when making investment decisions. Remember, this article does not provide investment advice. Stay informed and make wise choices!

Bitcoin (BTC) and Top Cryptocurrency Price Analysis

Bitcoin Surges Above Resistance Zone

The recent surge in Bitcoin’s price has caught many market participants off guard as it easily broke through the resistance zone of $31,000 to $32,400. Typically, prices tend to consolidate or hesitate near strong resistance levels, but this time was different. The sharp rally indicates a resumption of the uptrend, and buyers are expected to defend the crucial support levels at $32,400 and $31,000 with determination. If the price successfully bounces back from this support zone, it could pave the way for a further upward movement towards the $40,000 mark. However, a drop below $31,000 could suggest that the recent breakout was a false signal.

Anticipation of Bitcoin Spot ETF Approval

Market participants are currently optimistic about the approval of a Bitcoin spot exchange-traded fund (ETF) in the near future. Analysts believe that once the ETF receives the green light, Bitcoin’s price will experience a significant surge. Bloomberg ETF analyst Eric Balchunas has expressed confidence in the listing of BlackRock’s spot Bitcoin ETF on the Depository Trust & Clearing Corporation (DTCC), considering it a significant step towards bringing the ETF to the market. However, it is important to note that the listing of the ETF does not imply regulatory approval. Despite this, the anticipation of an ETF approval continues to drive the demand for Bitcoin.

Bitcoin Price Analysis

The recent rally in Bitcoin’s price indicates the resumption of its upward trend. This surge demonstrates the continued strength and potential of the cryptocurrency. Investors and traders are closely monitoring Bitcoin’s performance as it has the ability to set the tone for the broader cryptocurrency market. It is important to keep a close eye on the support and resistance levels to make informed decisions. The $32,400 and $31,000 levels are crucial support zones that buyers are expected to defend. A successful bounce back from these levels could lead to further upward movement, while a drop below $31,000 may indicate a potential reversal or temporary setback.

Altcoin Price Analysis

Ether (ETH) Price Analysis

Ether, the second-largest cryptocurrency by market capitalization, has shown signs of a potential shift in its trend. Breaking above the resistance level of $1,746, ETH has signaled a bullish move. However, the price faced selling pressure at higher levels, indicating a challenging battle near the $1,746 mark. Traders should closely observe the price’s behavior around this level, as a sustained hold above it could lead to further gains towards $1,900 and $2,000. On the other hand, a drop below $1,746 may extend the consolidation phase for ETH.

BNB (BNB) Price Analysis

BNB, the native cryptocurrency of the Binance exchange, experienced a rally above the immediate resistance level of $223. However, the bulls struggled to maintain momentum and clear the hurdle at $235. Currently, sellers are attempting to pull the price back below $223, suggesting a potential range-bound movement between $203 and $235. Nevertheless, the positive territory of the RSI and the upward turn of the 20-day EMA indicate that the bulls still have the upper hand. A rebound from $223 could improve the chances of a rally towards $250 and eventually $265.

XRP (XRP) Price Analysis

XRP has been oscillating within a wide range between $0.41 and $0.56 for several months. Although the price briefly broke above the resistance level, the long wick on the candlestick indicates that bears are attempting to guard this level. Typically, in a range-bound market, traders tend to sell near the overhead resistance. If the price reaches the moving averages, it suggests that XRP may remain within the $0.56 to $0.46 range for a few more days. However, a breakout above $0.56 could signal the start of a new upward movement, with potential targets at $0.66 and $0.71.

Solana (SOL) Price Analysis

Solana has reached its pattern target of $32.81, resulting in a brief correction. This suggests that the sentiment remains bullish, with buyers quickly stepping in to purchase any minor dips. The price has once again surged above $32.81, indicating the start of the next leg of the uptrend. However, the overbought territory of the RSI suggests a potential minor correction or consolidation in the near term. Traders should closely monitor the support level at $29.50, as a break below it may lead to a further decline towards $27.12. On the other hand, strong buying pressure is expected at this level.

Cardano (ADA) Price Analysis

Cardano has recently surpassed the resistance level of $0.28, but the presence of selling pressure at higher levels is evident from the long wick on the candlestick. The ADA/USDT pair is likely to face a tough battle near the $0.28 mark, and a sustained drop below this level could indicate a rejection of the breakout. In such a scenario, the pair may remain within the $0.24 to $0.28 range for some time. However, a rebound from $0.28 and a rise above $0.30 would suggest that the bulls have flipped the level into support, potentially initiating a new upward move towards $0.32 and $0.38.

Dogecoin (DOGE) Price Analysis

Dogecoin encountered heavy selling pressure at $0.07, resulting in a period of correction or consolidation. However, the fact that the price did not give up much ground indicates that the bulls are not closing their positions hastily. This suggests that there is a possibility of a break above $0.07, leading to a surge towards $0.08. The bullish crossover on the moving averages and the overbought territory of the RSI further support the dominance of the bulls. However, a drop below $0.06 would shift the advantage to the bears.

Toncoin (TON) Price Analysis

Toncoin faced resistance at $2.26, indicating that the bears are defending the $2.31 resistance level. The first support on the downside is at the moving averages, and a rebound from this level would suggest positive sentiment and buying interest. This could increase the likelihood of a break above $2.31, potentially retesting the formidable resistance at $2.59. Conversely, a drop below the moving averages would indicate a consolidation phase between $1.89 and $2.31. To regain control, the bears would need to sink the price below $1.89.

Chainlink (LINK) Price Analysis

Chainlink recently broke out of a multi-month consolidation phase, surpassing the overhead resistance at $9.50. Although sellers attempted to pull the price back below this level, aggressive buying at lower levels prevented a significant decline. The buying pressure has continued, and if the price surpasses the pattern target of $13.50, it may reach $15. However, traders should be aware that the overbought levels on the RSI suggest the possibility of a minor correction or consolidation in the near term. To prevent further upside, bears would need to push the price below $9.50.

Polygon (MATIC) Price Analysis

Polygon experienced a surge above the resistance level of $0.60, indicating accumulation at lower levels. The upward turn of the 20-day EMA and the overbought territory of the RSI suggest a potential trend change. If the price remains above $0.60, it could signify the start of a new upward movement, with targets at $0.70 and $0.80. However, a break below $0.60 may suggest that the rally above this level was a false breakout, potentially trapping aggressive bulls and leading to a drop towards the moving averages. Traders should closely monitor this level for further price action.

Conclusion

Bitcoin and Top Cryptocurrency Potential Price Movements

See more : WhiteList Zone partners with Cointelegraph Accelerator

Bitcoin’s recent surge above the resistance zone has sparked optimism among market participants. The anticipation of a Bitcoin spot exchange-traded fund (ETF) approval has further fueled bullish sentiment. Analysts predict potential price rallies for Bitcoin and other top cryptocurrencies like Ether, Binance Coin, XRP, Solana, Cardano, Dogecoin, Toncoin, Chainlink, and Polygon. However, it’s important to note that price movements in the cryptocurrency market can be volatile and unpredictable. Traders and investors should closely monitor the market and use technical analysis tools to make informed decisions.

Importance of Research and Caution in Investment Decisions

When it comes to investing in cryptocurrencies, thorough research and caution are crucial. It’s important to understand the fundamentals and market trends of each cryptocurrency before making any investment decisions. Additionally, staying updated with the latest news and developments in the cryptocurrency space can provide valuable insights. It’s also advisable to diversify your investment portfolio and not put all your eggs in one basket. Remember, investing in cryptocurrencies carries risks, and it’s essential to only invest what you can afford to lose. Consulting with a financial advisor or cryptocurrency expert can also provide valuable guidance in making informed investment choices.

Bitcoin has surged above resistance levels, defying expectations and sparking anticipation for the approval of a Bitcoin spot exchange-traded fund (ETF). Market participants are bullish, with analysts predicting a potential 74.1% rally in Bitcoin’s price after the ETF is launched. This article analyzes the charts of the top 10 cryptocurrencies, including Bitcoin, Ether, BNB, XRP, Solana, Cardano, Dogecoin, Toncoin, Chainlink, and Polygon, to determine their potential price movements. Remember to conduct thorough research and exercise caution when making investment decisions. Stay informed and make wise choices!

Source: https://cupstograms.net

Category: Crypto